Valour

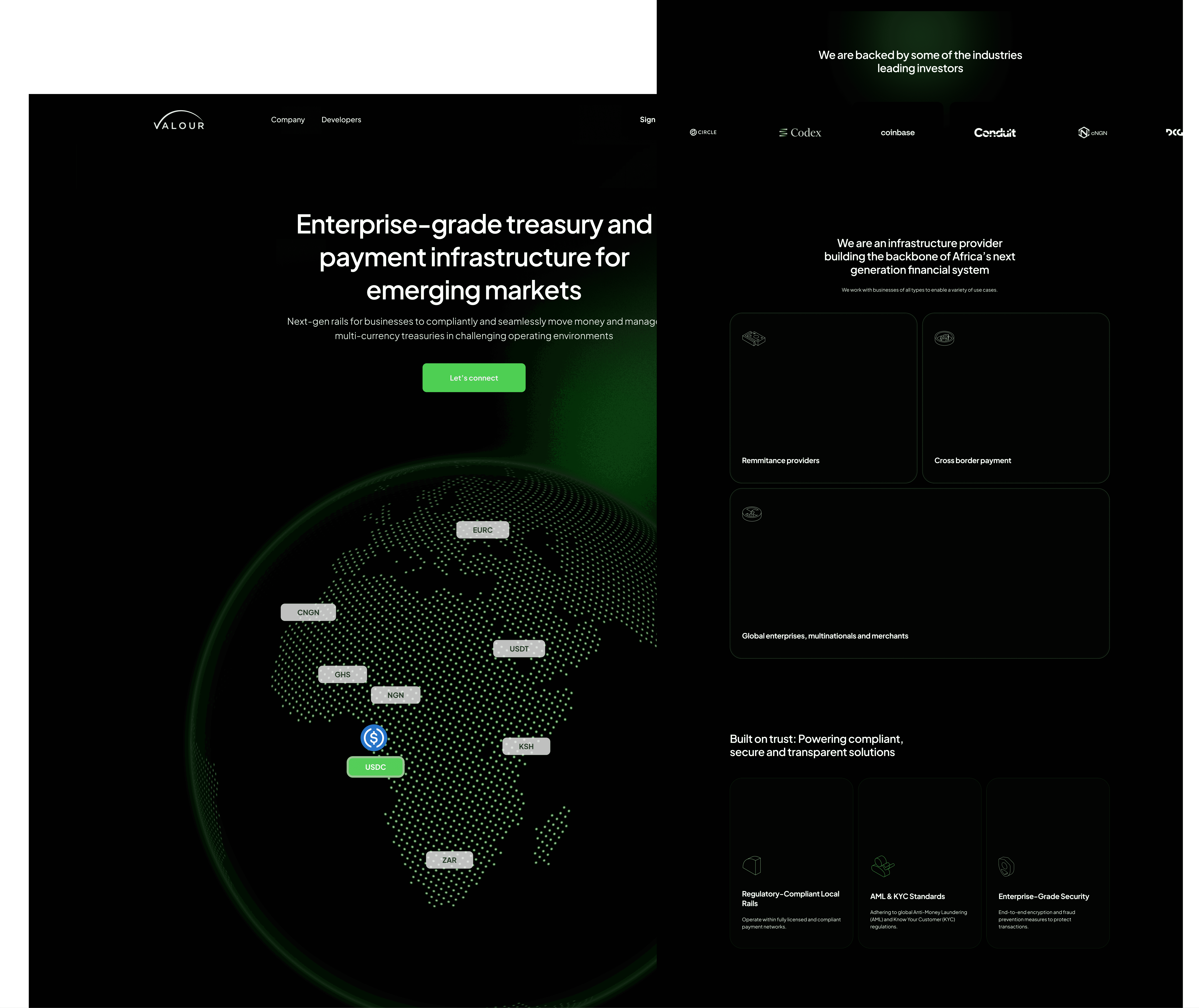

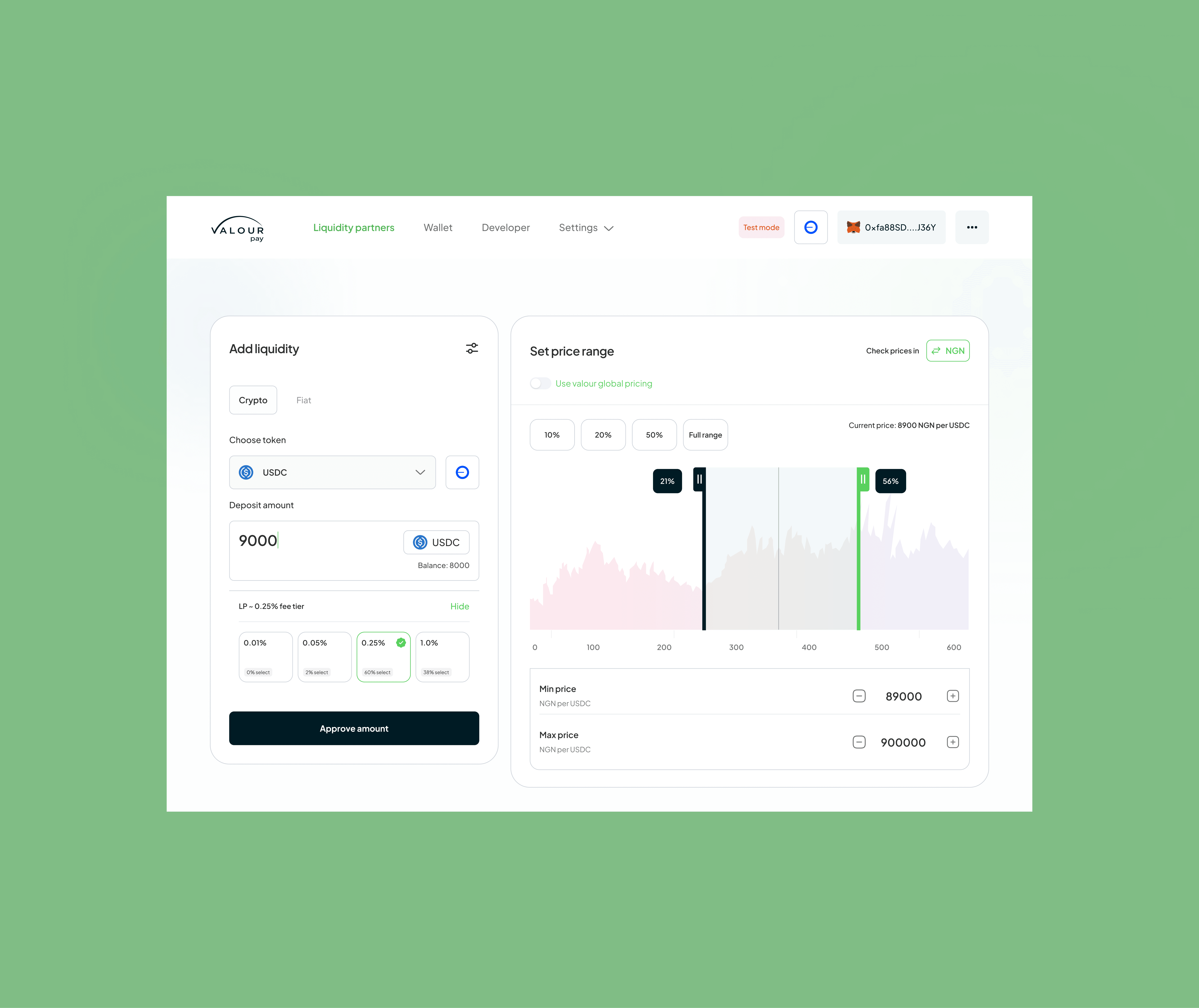

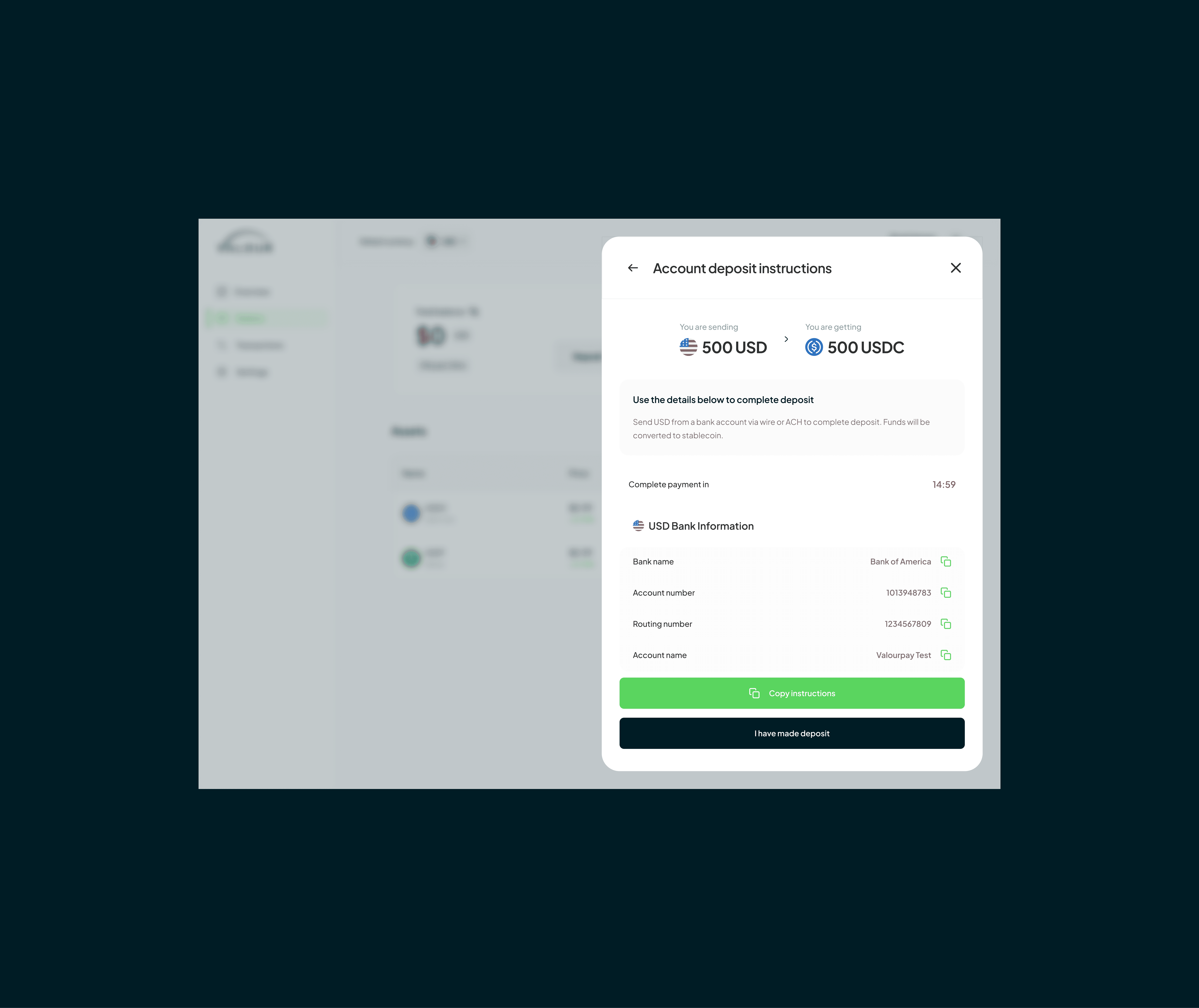

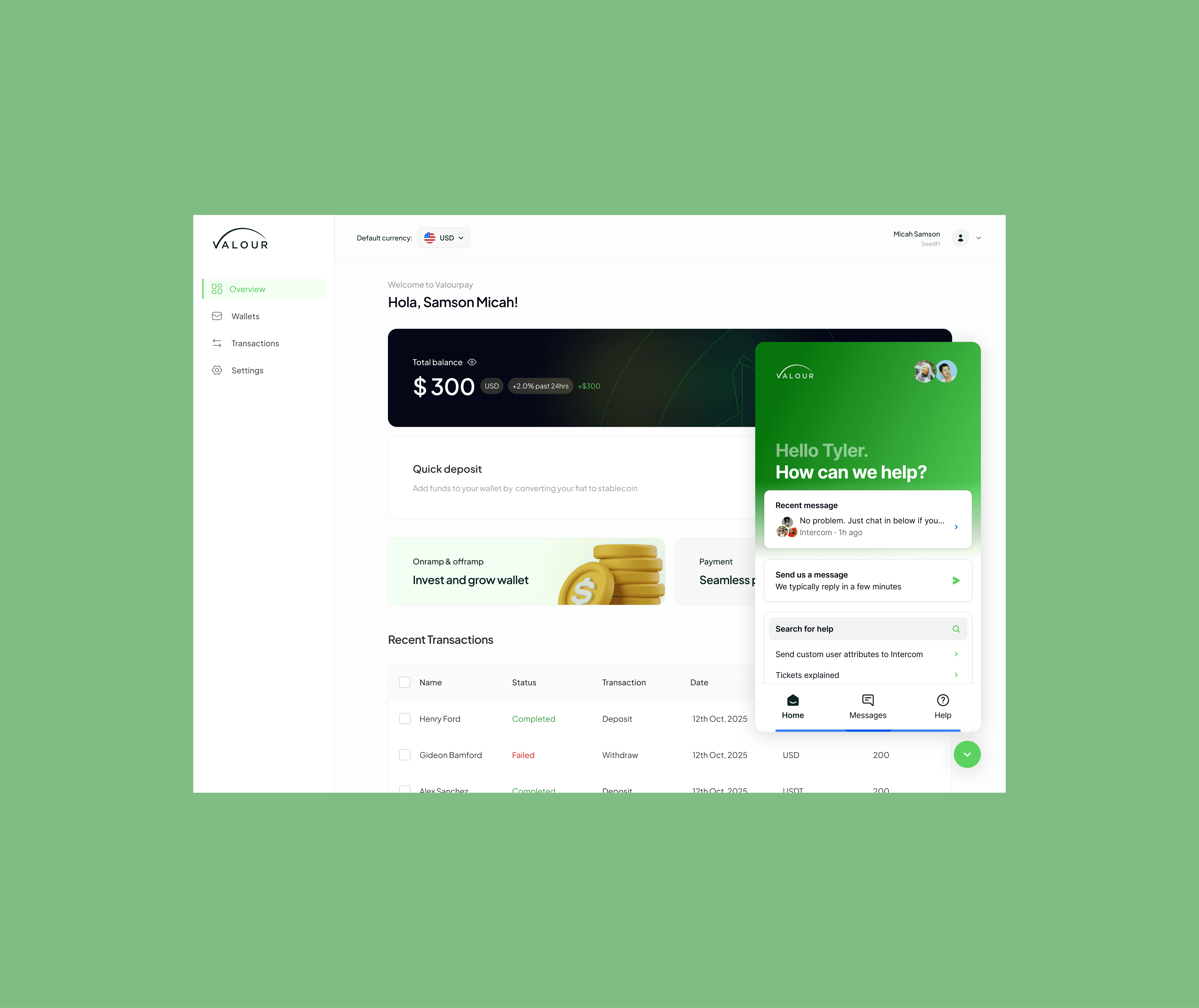

A unified platform that lets users send, receive, and convert funds instantly without friction, complexity, or uncertainty.

00

Problem

As crypto adoption grew, many users faced fragmented, confusing experiences when trying to manage both traditional and digital assets. They had to juggle multiple apps, manual conversions, and unclear transaction fees. Common pain points uncovered included: Disjointed user journeys between crypto and fiat accounts. Lack of real-time clarity on exchange rates and transaction status. Overly technical interfaces that alienated first-time users. The challenge was to bridge both financial ecosystems in a way that felt seamless, secure, and human-centered.

Solution

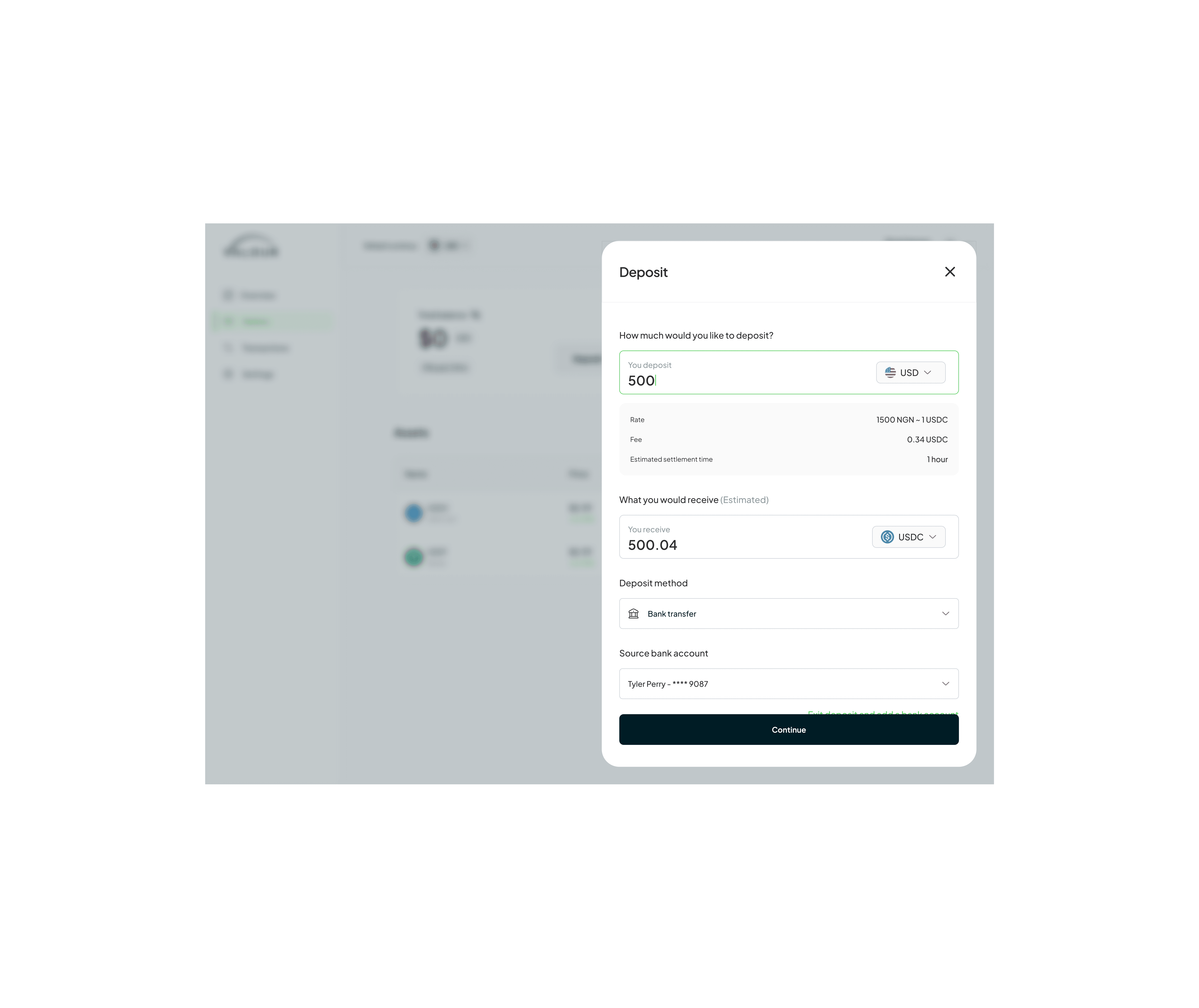

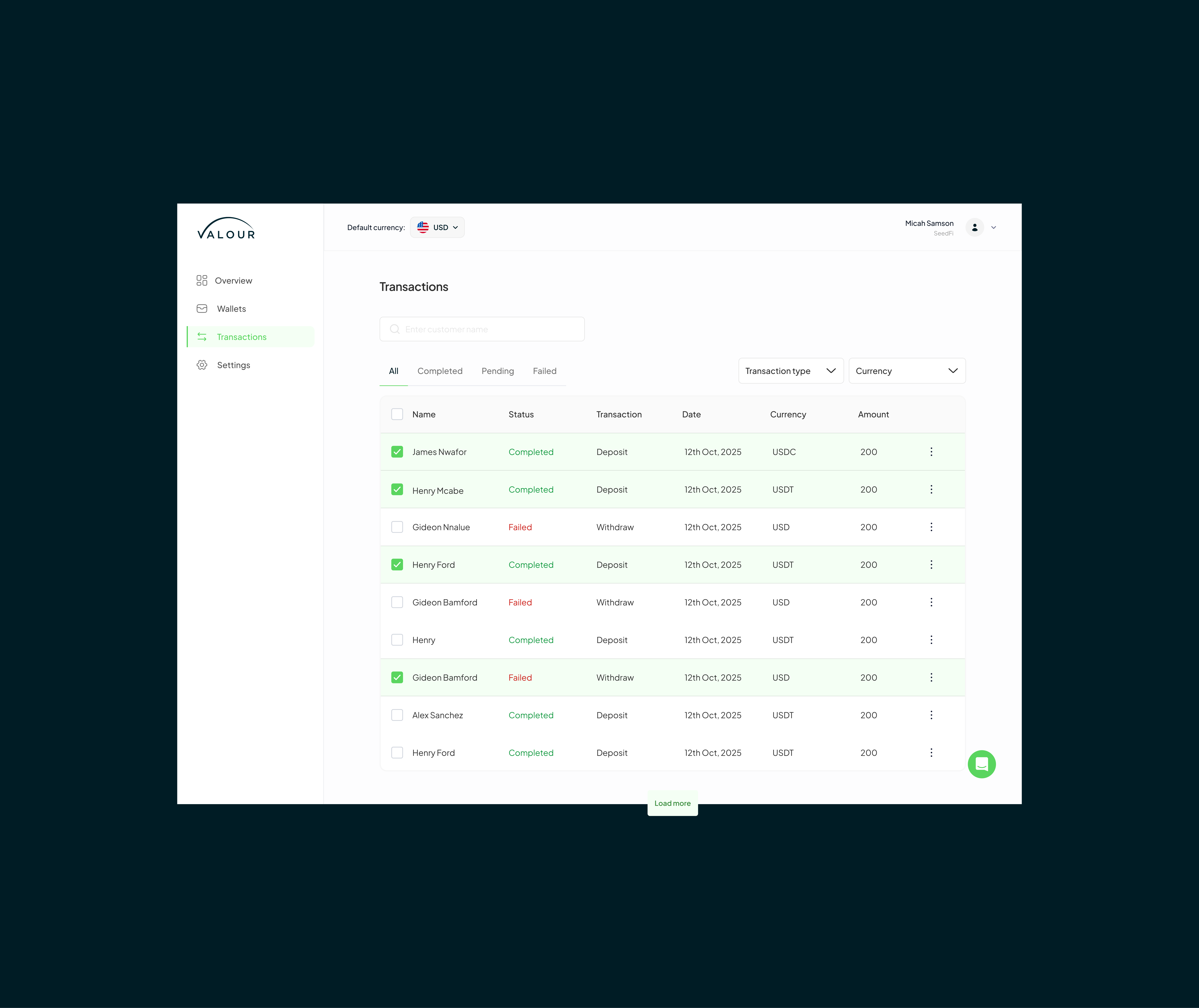

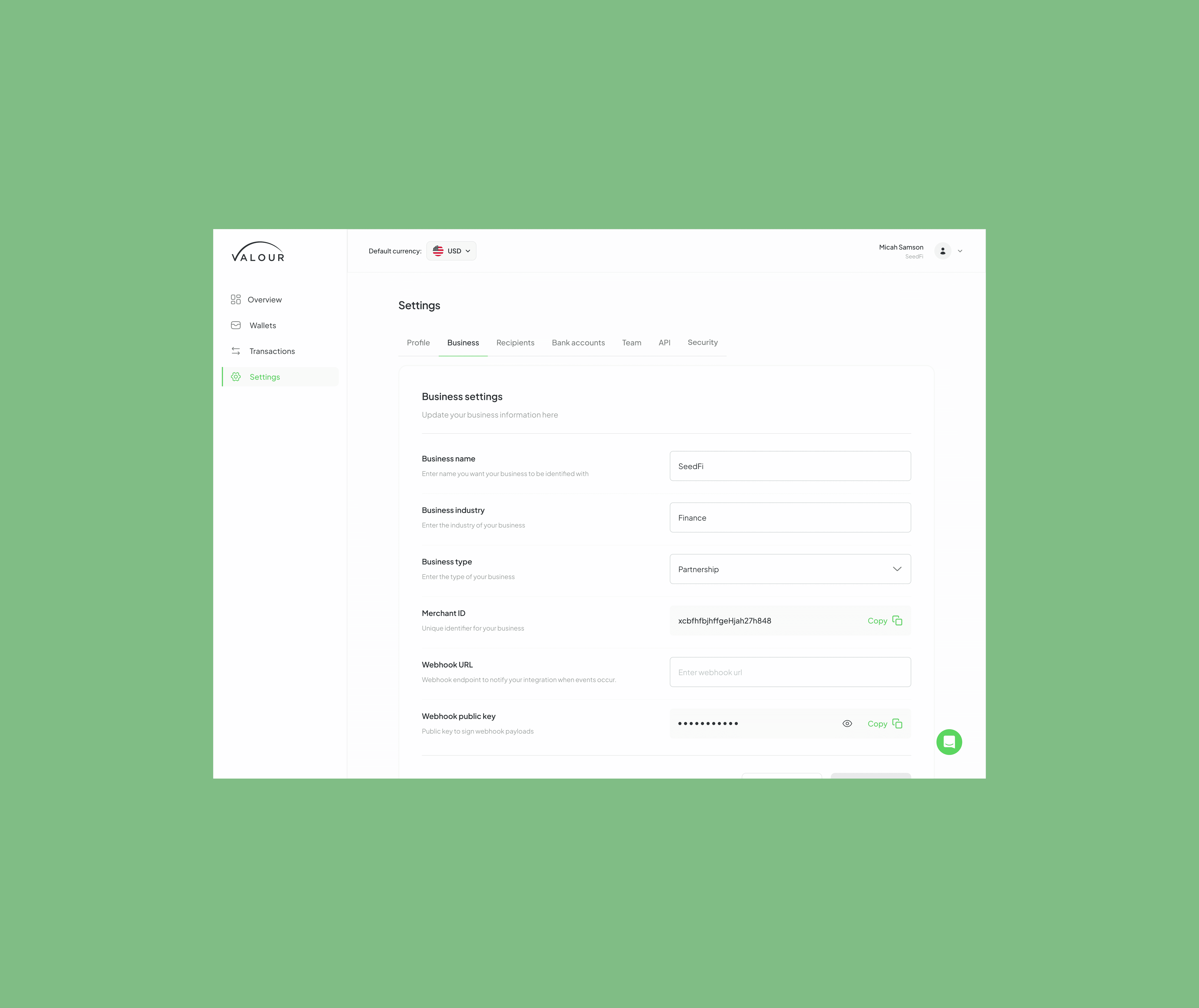

To effectively address these challenges, with Pharmora we: Unified Dashboard: A single view of crypto and fiat balances, allowing instant conversions with real-time rate updates. Simplified Onboarding: Reduced registration steps from 5 to 3 screens, cutting drop-offs by an estimated 22%. Transparent Transactions: Added a detailed breakdown of conversion fees and processing times before user confirmation. Visual Hierarchy & Accessibility: Used consistent iconography, color cues for transaction states, and readable typography for transparency and confidence.

When I joined Valourpay, the vision was to create a seamless payment experience that connects users across the Web3 and fiat ecosystem. The goal was to build a platform where anyone could effortlessly send, receive, and convert funds between crypto and traditional currencies all within a secure, intuitive interface and mainly focused in Africa.To achieve this vision, I conducted extensive research into the fragmented landscape of digital payments and crypto adoption. Through user interviews and market analysis, I identified key pain points such as confusing onboarding flows, lack of transaction transparency, and users’ uncertainty about exchange rates and fees. These insights informed the product’s design direction transforming Valourpay into a unified, trustworthy, and frictionless payment platform that bridges both worlds with clarity and confidence..

Discovery & Research : Survey and Interviews

To ground the design direction, I conducted:

User Interviews: 12 participants — freelancers, traders, and everyday senders who relied on crypto for international transactions.

Competitive Analysis: Benchmarked against platforms like Moonpay, Revolut, and Coinbase to assess their onboarding, security flows, and transaction transparency.

Journey Mapping: Identified friction points from onboarding → wallet connection → fund conversion → payout.

Key Findings:

67% of users didn’t fully understand how rates or fees were calculated.

Most users equated “complex UI” with “untrustworthy product.”

Users desired a single dashboard to track all fiat and crypto balances.

These insights became the foundation for our product strategy — simplify, clarify, and unify.

Impact & Results

Although the MVP was in testing phase, we achieved:

User Confidence: Post-test surveys showed a 36% increase in perceived trustworthiness of the product.

Reduced Friction: Simplified onboarding flow shortened completion time by 40 seconds on average.

Improved Engagement: Beta users returned to the dashboard 25% more frequently to manage multiple accounts.

Learnings & takeaways

Designing for both Web3 and fiat systems required balancing technical complexity with human simplicity.

This project reinforced that trust is the real currency in fintech, clarity, not flash, drives adoption.

If revisited, I’d further explore predictive insights showing users the best times to convert based on market conditions to extend Valourpay’s value beyond transactions

01

02

03

04

05

06

07

08

see also